Insurance in Pakistan has always been a sector full of potential yet burdened by challenges, and as 2025 unfolds, the landscape for general insurance is shifting in noticeable ways. While life insurance continues to attract its share of attention, general insurance, particularly motor and travel insurance, remains at the center of consumer demand and regulatory focus. This shift is driven by increasing mobility, rising consumer expectations, and an expanding middle class, but it also faces hurdles such as low penetration rates, uneven enforcement of laws, and gaps in digital adoption. Companies like Habib Insurance, one of the oldest and most respected players in the country, are at the forefront of navigating these trends and responding to the challenges that define the general insurance market today.

The overall insurance market in Pakistan has witnessed growth in recent years, with gross written premiums and industry assets steadily expanding. Despite this, penetration remains low compared to regional peers. This gap highlights both the opportunities and obstacles present in the market. General insurance, unlike life insurance, caters to tangible risks that most people face in their daily lives vehicles on the road, travel risks abroad, and unforeseen emergencies. Yet for all its importance, the awareness and uptake of general insurance products, especially motor and travel insurance, remain limited. Companies such as Habib Insurance and others continue to invest in raising awareness while simultaneously modernizing their distribution channels to meet consumer needs.

One of the strongest trends shaping the industry in 2025 is digital transformation. Consumers are now accustomed to convenience in nearly every service they use, and insurance is no exception. Digital platforms, mobile applications, and insurtech partnerships are enabling insurers to reach customers more efficiently. Travel Insurance can be bought online through the website which can give ease to the customers. Also Motor Insurance quotes can be taken through the website. Digital Claims are now offered and customers can now claim online.,

Motor insurance continues to dominate general insurance in Pakistan, both in terms of volume and visibility. Almost every driver knows that motor insurance is mandatory, but in practice, enforcement is weak, and a significant number of vehicles remain uninsured or underinsured. This gap poses a challenge not just to insurers but also to society at large, as uninsured vehicles create risks for other road users. Moreover, the motor insurance segment struggles with low profitability due to thin margins. Rising repair costs, inflation, and the prevalence of fraudulent claims add to the burden. Claims processing is often lengthy, with manual inspections and paperwork slowing things down. Habib Insurance and other established firms are working on streamlining these processes, but it requires industry-wide cooperation to set standardized repair networks and stronger fraud detection systems. The Securities and Exchange Commission of Pakistan (SECP) has recently emphasized reforms in third-party motor insurance, aiming to bring greater transparency and efficiency, but execution is still in its early stages.

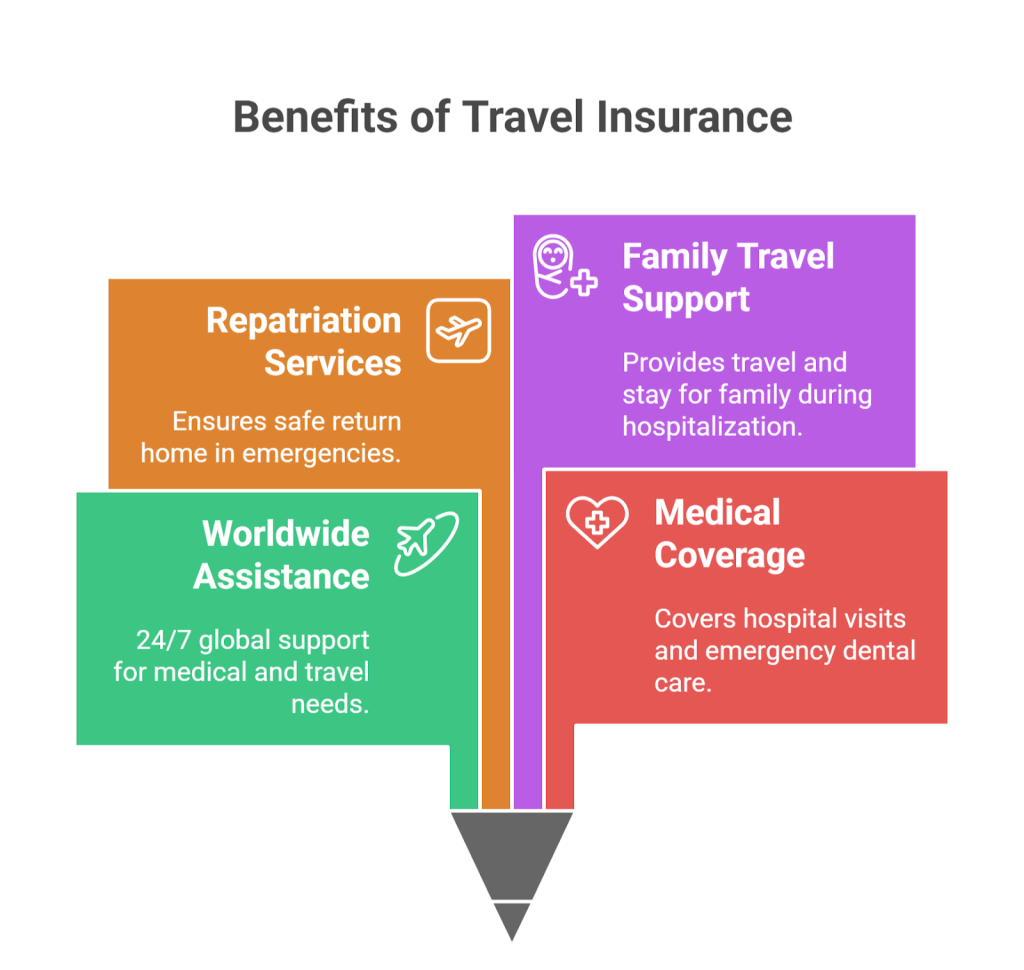

Beyond motor insurance, travel insurance has become one of the most dynamic areas of general insurance globally, and Pakistan is no exception. As more Pakistanis travel abroad for work, leisure, and religious purposes such as Hajj and Umrah, the need for reliable travel insurance is increasing. With trips becoming costlier and travelers seeking peace of mind, products that cover medical emergencies, trip cancellations, lost baggage, or flight delays are gaining traction. In 2025, travel insurance is also evolving with new product innovations, including “Cancel for Any Reason” policies and specialized pilgrimage coverage. Yet, despite this global momentum, travel insurance in Pakistan remains a niche product. Many travelers are still unaware of its value or assume that their credit card provides sufficient coverage, which often proves inadequate in emergencies. Companies like Habib Insurance, with their longstanding reputation, have an opportunity to educate the market by building trust and offering tailored travel insurance products that address the specific needs of Pakistani travelers, especially for pilgrimage and diaspora-related travel.

A closer look at the challenges reveals that awareness and accessibility are the biggest barriers. For motor insurance, many drivers view premiums as a burden rather than protection, and the weak enforcement of compulsory third-party coverage perpetuates this mindset. For travel insurance, lack of integration with booking platforms in Pakistan limits its reach. Globally, airlines and online travel agencies embed travel insurance directly into the checkout process, dramatically boosting uptake. In Pakistan, insurers need stronger partnerships with travel agencies, airlines, and corporate employers to replicate this success. Habib Insurance, with its established presence and credibility, is well-positioned to lead such collaborations and bring travel insurance closer to mainstream adoption.

Companies like Habib Insurance are offering 24/7 global assistance in travel insurance and enables a customer to make direct settlements internationally. This has helped in gaining the trust of the customers and ending the trust deficit that existed from ages.

Despite the challenges, there are significant opportunities on the horizon. Telematics and usage-based pricing in motor insurance can reward safe drivers and make coverage more affordable. Standardized repair networks can reduce disputes and enhance trust in claims settlements. For travel insurance, niche products tailored to Pakistani travelers such as coverage for Hajj and Umrah or for overseas workers can tap into large, underserved markets. Furthermore, embedding insurance into digital platforms, whether at the point of car purchase or during travel bookings, can transform accessibility.

For the industry as a whole, the path forward requires a combination of innovation, regulation, and consumer education. Regulators like SECP are pushing for greater transparency, while insurers like Habib Insurance are modernizing their offerings. However, real progress will depend on execution. Building centralized claims databases, automating parts of the claims process, and expanding consumer education campaigns are practical steps that can drive adoption. Ultimately, insurance in Pakistan can only achieve its potential if it moves from being seen as an afterthought or a regulatory burden to being recognized as an essential financial safeguard.

To know more visit www.habibinsurance.net